In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively. For expatriates working for Labuan International there is a special rebate where foreign directors income is zero tax and expatriate employees are subject to a 50 rebate in their.

Progressive Tax Definition Taxedu Tax Foundation

Find Out Which Taxable Income Band You Are In.

. Instead he announced a few tax reliefs including the new lifestyle tax relief. Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Malaysia. For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups.

Key Malaysian Income Tax Info Do I need to file my income taxYes you would need to file your income tax for this past year if. It also incorporates the 2018 Malaysian Budget proposals announced on 27 October 2017. Heres How A Tax Rebate Can Help You Reduce Your Tax Further.

The new lifestyle tax is not exactly new. Of course these exemptions mentioned in the example are not the only one. These Are The Personal Tax Reliefs You Can Claim In Malaysia.

Corporate - Other issues. The scope of income to be taxed covers all classes of income including passive income eg. Individual Life Cycle.

The system is thus based on the taxpayers ability to pay. Income tax in Malaysia is imposed on income accruing in or derived from. RM 63000 RM 1400 RM 9000 RM 4400 RM 48200.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. All BR1M Up Increased. Taxable Income RM 2016 Tax Rate 0 - 5000.

Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained. Rates of tax Personal reliefs for resident individuals.

No guide to income tax will be complete without a list of tax reliefs. Her chargeable income would fall under the 35001 50000 bracket. Resident Individual tax rates for Assessment Year 2013 and 2014.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. However in his Budget 2017 speech Prime Minister Datuk Seri Najib Razak did not announce any change to personal income tax rates. Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower.

Introduction Individual Income Tax. Income earned in oversea remitted to Malaysia by a resident. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

On the First 2500. How Does Monthly Tax Deduction Work In Malaysia. Similarly those with a chargeable.

Which is why weve included a full list of income tax relief 2017 Malaysia here for your calculation. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice. Malaysia Personal Income Tax Rate.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. On the First 5000 Next 15000. Useful reference information on Malaysian Income Tax 2017 for year of assessment 2016 for resident individuals.

Tax Amount RM 0-2500. She would need to pay RM600 on the first RM35000 and 8 on the remaining RM4060 RM32480 which totals to RM92480. PwC 20162017 Malaysian Tax Booklet PERSONAL INCOME TAX Tax residence status of individuals An individual is regarded as tax.

On the First 5000. Dividends interest royalties etc There will however be a transitional period from 1 January 2022 to 30 June 2022 where foreign-sourced income remitted to Malaysia will be taxed at the rate of 3 on gross income. 12 rows Income tax rate Malaysia 2018 vs 2017.

20001 - 35000. Chargeable income RM Calculations RM Tax Rate. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified.

2018 Personal Tax Incentives Relief for Expatriate in Malaysia. Every individual is subject to tax on income earned in Malaysia or received in Malaysia from outside Malaysia. Income Tax Rates and Thresholds Annual Tax Rate.

Choose a specific income tax year to see the Malaysia income tax rates and personal allowances used in the associated income tax. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia.

A much lower figure than you initially though it would be. Chargeable income RM54000 Taxable Income RM9000 Individual Tax Relief RM5940 EPF contribution tax relief RM39060. BR1M to continue focus on strengthening the economy.

20172018 Malaysian Tax Booklet. The rate was cut. Technical or management service fees are only liable to tax if the services are rendered in MalaysiaWhile the 28 tax rate for non-residents is a 3 increase from the previous years 25.

It combines a few tax reliefs into one allowing taxpayers to claim yearly. Malaysia Non-Residents Income Tax Tables in 2019. Affin Hwang thinks a 1 percentage point cut to corporate tax effective effective in 2018 will be announced.

These will be relevant for filing Personal income tax 2018 in Malaysia. Some items in bold for the above table deserve special mention. Personal income tax in Malaysia is charged at a progressive rate between 0 28.

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Malaysia Personal Income Tax Rates Table 2012. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

Calculations RM Rate TaxRM A. 5001 - 20000.

Individual Income Tax In Malaysia For Expatriates

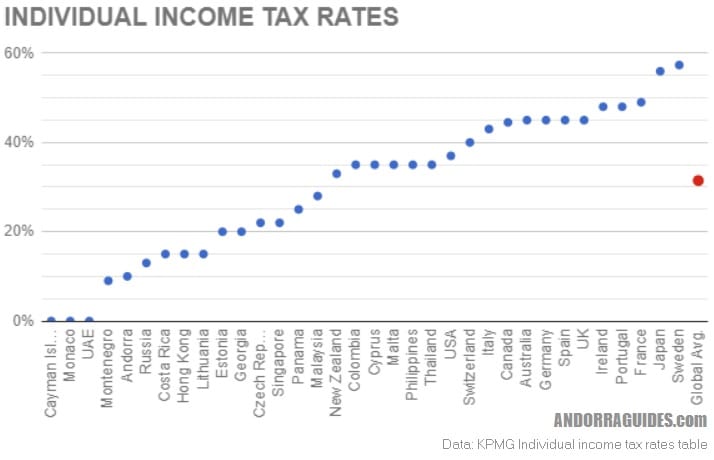

World S Highest Effective Personal Tax Rates

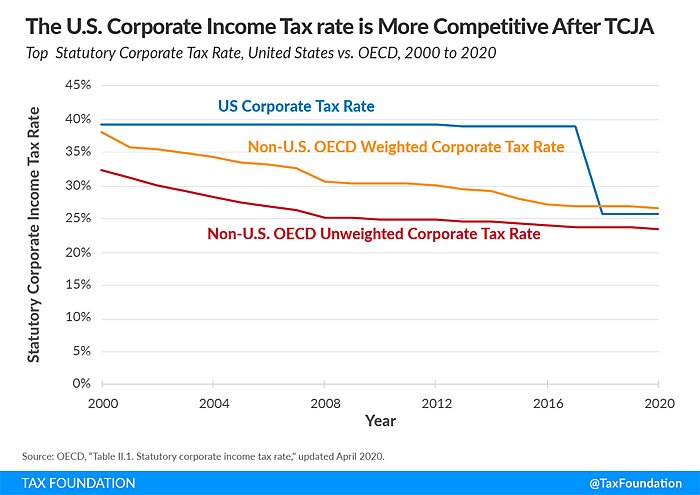

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

World S Highest Effective Personal Tax Rates

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

Asiapedia Iras 2017 Singapore Personal Income Tax Dezan Shira Associates

Doing Business In The United States Federal Tax Issues Pwc

The Andorra Tax System Andorra Guides

Income Slab Tax Rates For Ay 2018 19 Fy 2017 18 Income Tax Return Income Tax Tax Exemption

How To Calculate Foreigner S Income Tax In China China Admissions

Corporate Income Tax And Effective Tax Rate Download Table

Effective Tax Rate Formula Calculator Excel Template

Malaysian Tax Issues For Expats Activpayroll

Tax Rates Of Nordic Countries World Europe And Oecd Countries 4 Download Scientific Diagram

Thailand S New Personal Income Tax Structure Comes Into Effect Asean Business News

Effective Tax Rate Formula Calculator Excel Template

Tax Structure Tax Base Tax Rate Proportional Regressive And Progressive Taxation

Corporation Tax Europe 2021 Statista